A Last Will and Testament may be a legally binding document that stipulates how a person's assets, including real estate, personal property, and investments, are distributed after the person dies. This document is commonly referred to as a Last Will or Will. After the form is created and signed, in front of two witnesses, the will should be shared with all beneficiaries. It is not required for wills to be filed with the state but certain counties allow this to be done.

View Sample

View Sample

A Last Will and Testament is also known as:

A last will and testament is a legal document that details how a person's assets and properties will be distributed after their death. This legal document can also specify custody and guardianship details for the surviving children.

To complete your will, you should have a clear idea about what you want to happen to your financial and real estate assets. You should have personal information for the parties that will be receiving these assets in the event of your death. If you have the information you need, you can create a will without a lawyer's assistance.

The short answer is yes. If you are a legal adult, you need a last will and testament. Dying without a will is known in the legal world as dying "intestate". Essentially, if you have not made your wishes known and legally binding through a will, the state will decide how your property is divided. If you have a spouse or legally recognized partner but no children, then they receive all of your property. If you have children or have no legal partner, the estate's distribution has the potential to become confusing. In extreme instances, everything you own could become the state's property, simply because there was no legally binding will at the time of death.

You aren't required to hire a lawyer to create your will. However, it is best to seek legal counsel regarding the best course of action for planning your estate, given your financial circumstances. If you decide to do this on your own, there are many D.I.Y. books and online resources that can help you to do so (see our last will form above).

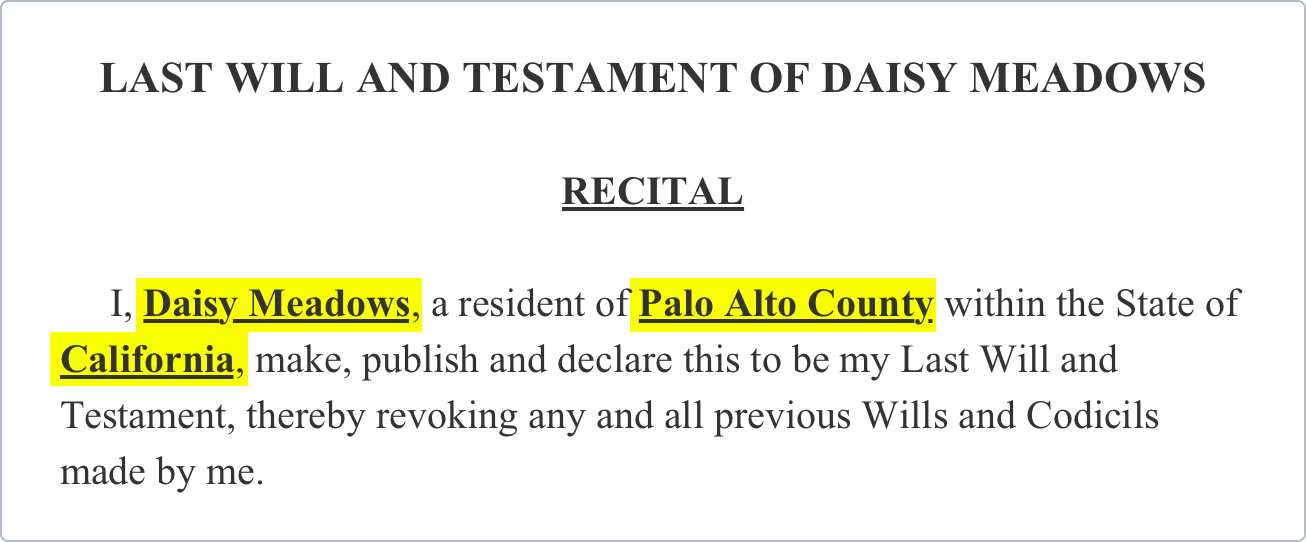

In this first section, state your name (the Testator or Testatrix) in the appropriate area. In this case, a Testator is an individual who will be releasing their belongings, possessions, and assets to other individuals once they pass away.

In this section, declare your marital status. If you are married, separated, engaged, or widowed, please list the other individual's name.

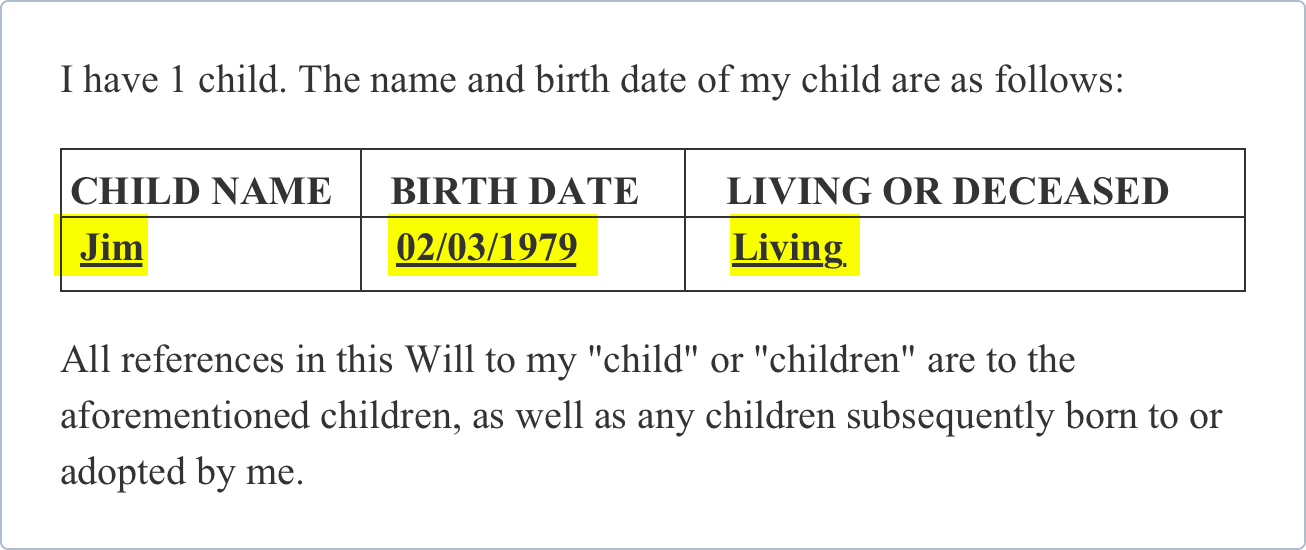

First, declare how many children you have. For each child, provide his or her name, date of birth, and whether they are living or deceased.

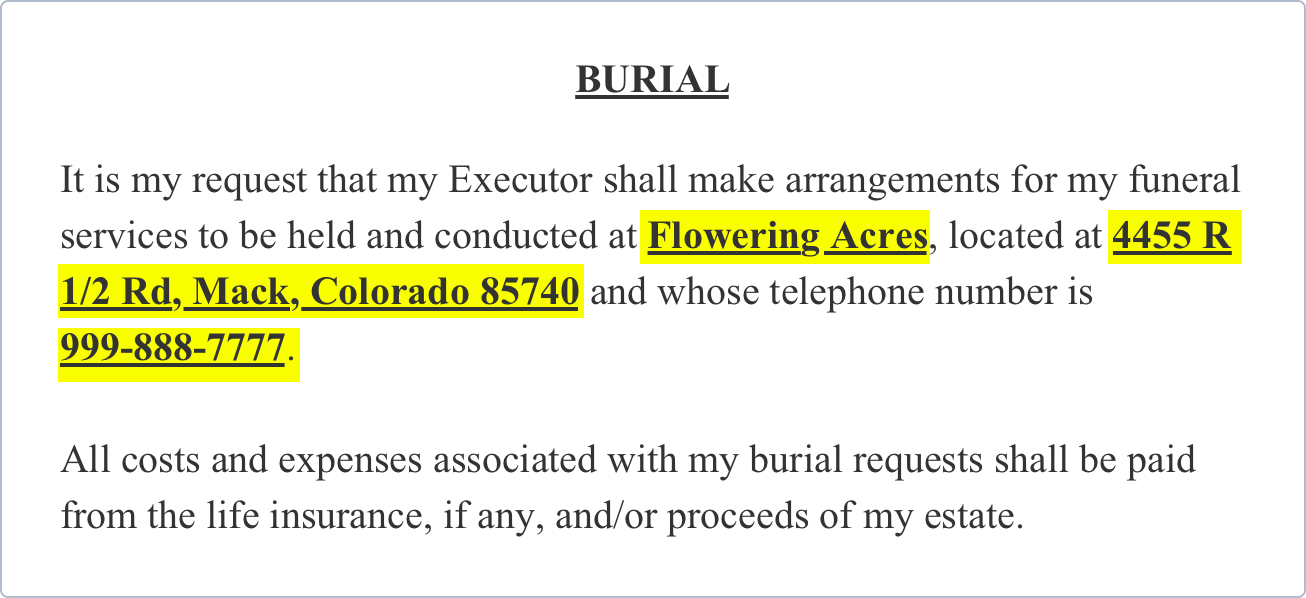

In this step, you will be listing your burial wishes and arrangements. If you know where you would like your funeral home arrangements made, or if arrangements have already been made, provide the following information:

If you will have a repast following your service, provide the following details:

If you've made burial arrangements, provide the Cemetery Name and Address.

Also, if you have any memorial wishes, or if you'd like your ashes spread over a body of water or something similar, specify these wishes in this step as well.

This section addresses your debts and expenses. In this section, declare the state laws in which taxes, debts, assets, etc., will be subject to.

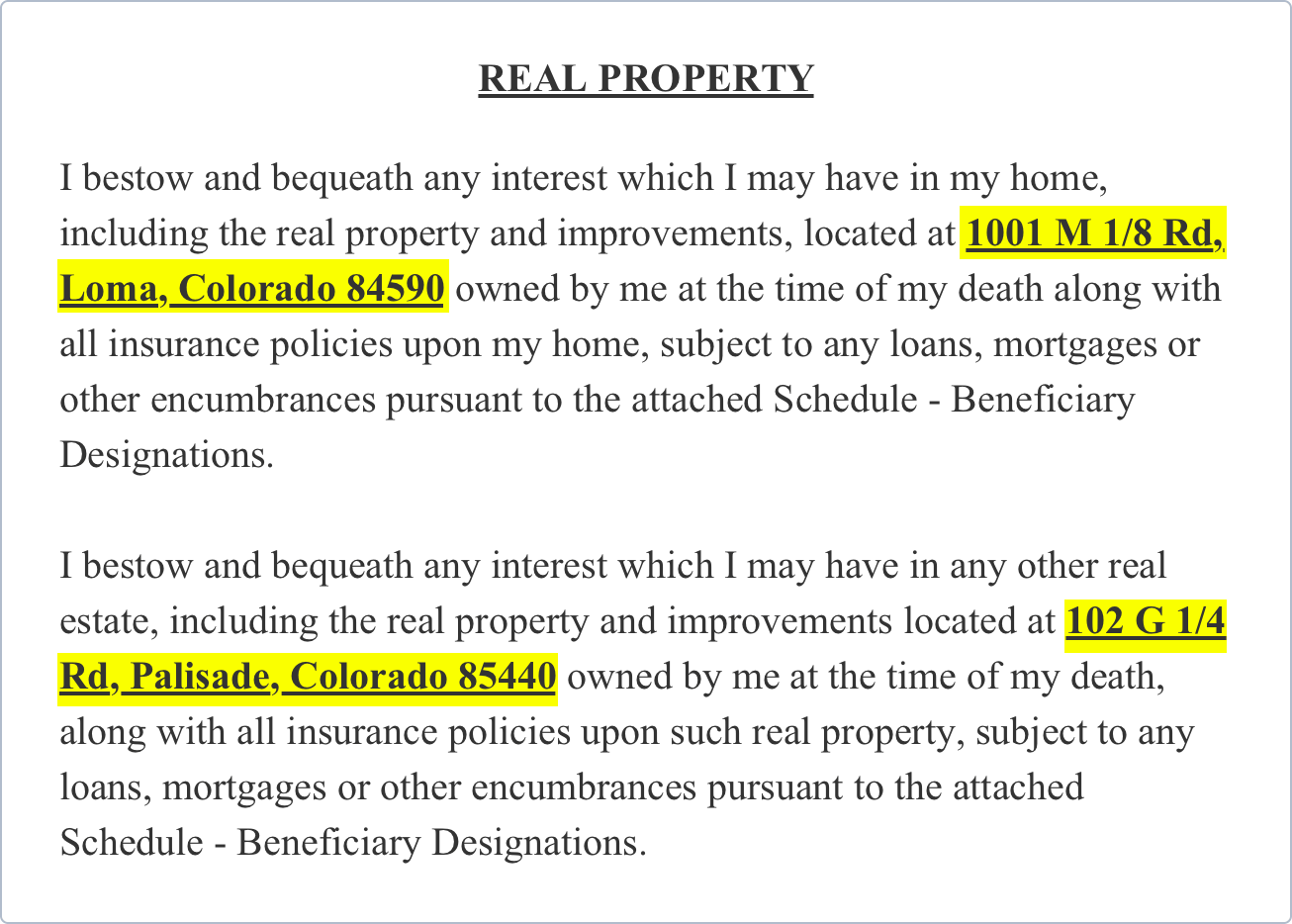

If you own a home or property, specify that here. Provide the address of your home/property

If you wish for someone to take care of your pets after you pass away, provide the following information of your appointed caretaker or pet organization:

Also, provide the following information for each pet:

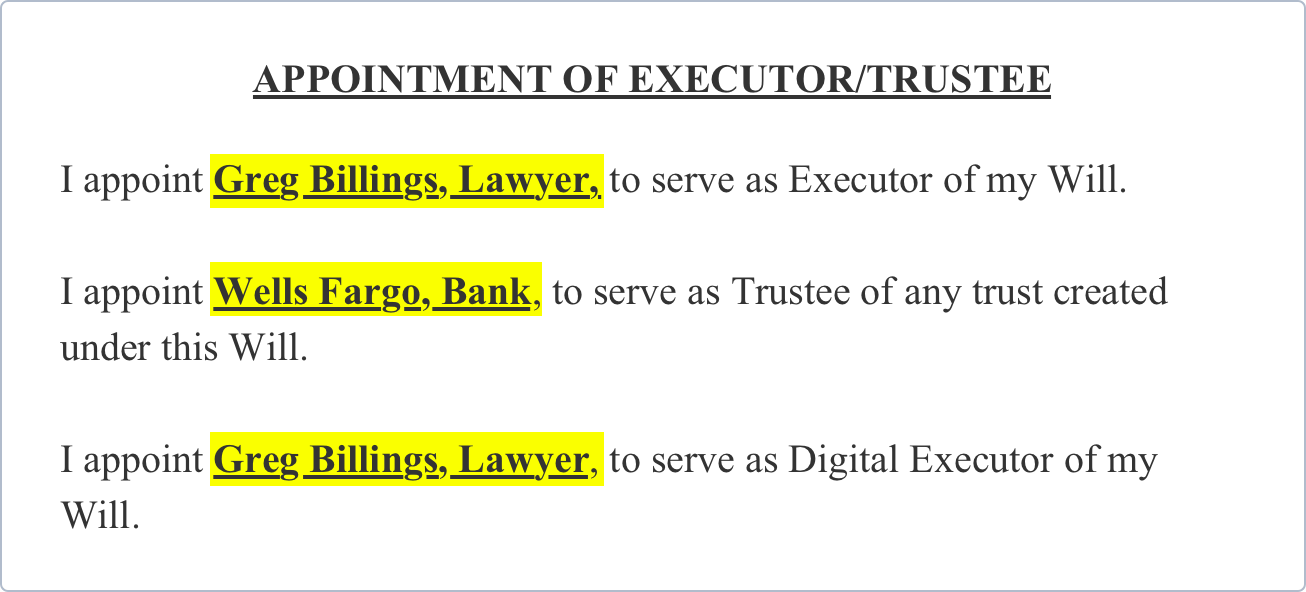

This section will allow you to appoint your Trustee or Executor. Do this by providing your Executor/Trustee's name and his or her relationship to you. Be sure to provide an alternative in case your primary Trustee or Executor is unavailable.

Also, if you have Digital Assets, be sure to appoint a Digital Executor. Digital assets are assets like royalties, copyrights, etc. If you have Digital Assets, be sure to list a Digital Executor by providing the following information:

Besides, provide the same information for an Alternate Digital Executor:

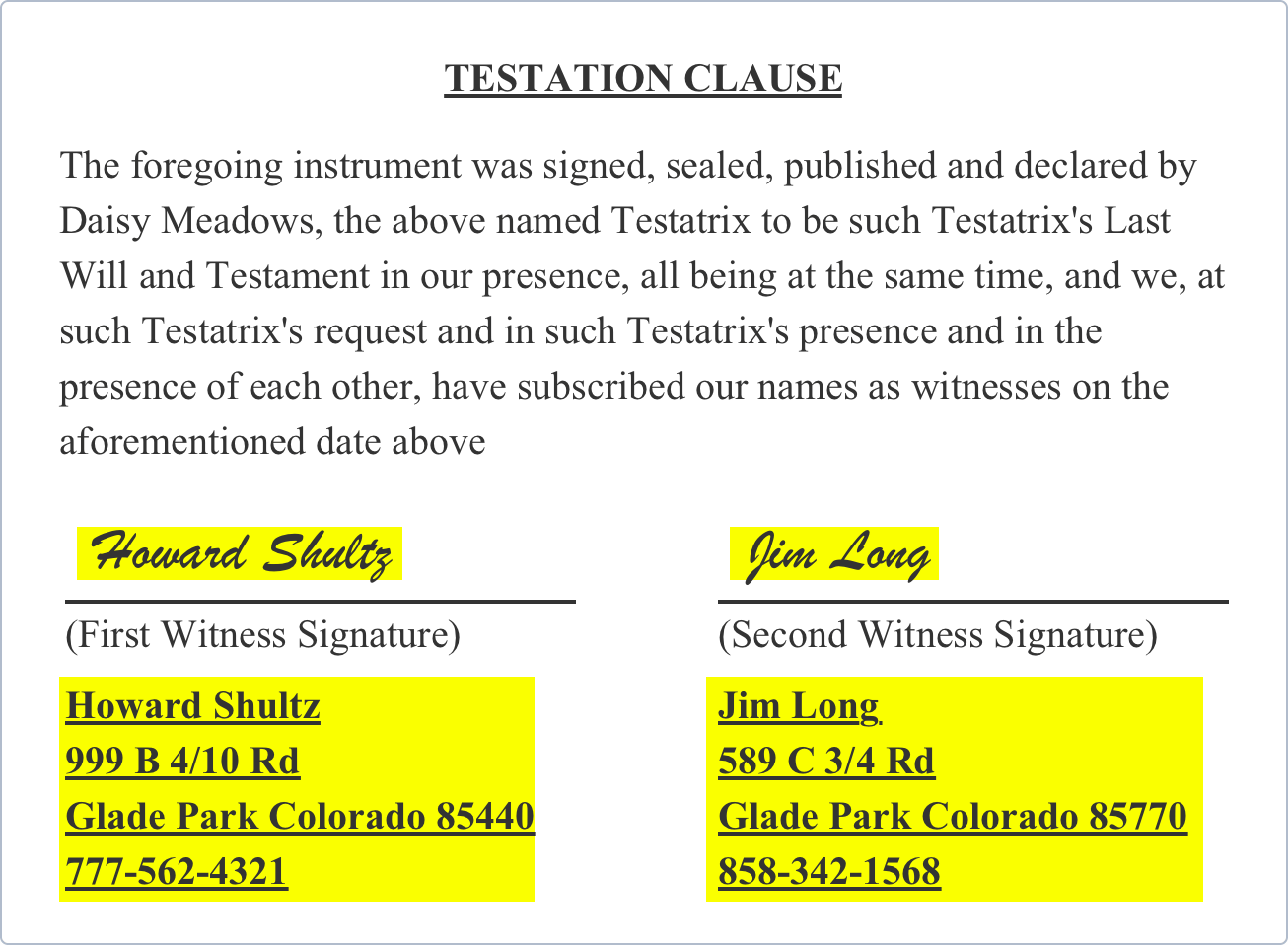

This portion allows the Testator to certify and seal the will, stating that they are of sound mind, and these are their wishes.

First, input your name (the Testator) the appropriate area, and sign, certifying that these are your wishes. Next, provide the following information for each witness:

First Witness' Signature, and;

Second Witness' Signature, and;

If you don’t have a will, the laws of your state will determine how your property is distributed. This means that your loved ones may not receive the property you wanted them to have.

Here are are some common scenarios about how your assets would be distributed without a will:

Any person of legal age (usually 18 years of age) may make a Last Will, although an exception may be made if you are married, in the military, or have been legally emancipated.

Most states require that you must be of "sound mind" to make a valid Will which means:

Most of your property can be given away in a will, but there are a few important exceptions:

If you have dependents or pets, you should consider what you want your will to specify for their care. You may need to select a guardian that you trust, who should be of legal age, to care for your children and/or pets.

You should consider creating a trust for the benefit of your minor children or pets. The trust should contain detailed instructions on how the funds should be used to care for the benefit of the trustees. If your children or pets need special care or attention, your will and trust should make this unambiguously clear.

A trust is essentially a pool of all your assets, including your investments, property, cash, etc. These assets are held in the trust for a beneficiary, usually a child or spouse. You appoint a trustee when you create a trust who will oversee its management. If you create a trust while you are alive, you may act in both the trustee and the beneficiary role. This enables you to determine how you want your assets distributed after you die while still having access to your assets now

Absolutely. FormSwift’s will template allows you to specify charities and amounts as part of the step by step process.

Each of these documents serves an important function, and a good estate plan will include all of them:

You can (and should) revise your will anytime there are major life changes that change your beneficiaries. If you need to make changes to your will, it is prudent to use a codicil form.